Exploring Gold IRA Investment Companies: A Comprehensive Observational…

페이지 정보

작성자 Niklas 작성일25-08-15 02:59 조회2회 댓글0건본문

In the ever-evolving landscape of funding alternatives, Gold Particular person Retirement Accounts (IRAs) have emerged as a well-liked selection amongst buyers seeking to diversify their portfolios and safeguard their assets against economic uncertainties. This observational research article delves into the world of Gold IRA investment companies, inspecting their operations, services, and the general market dynamics that influence investor conduct.

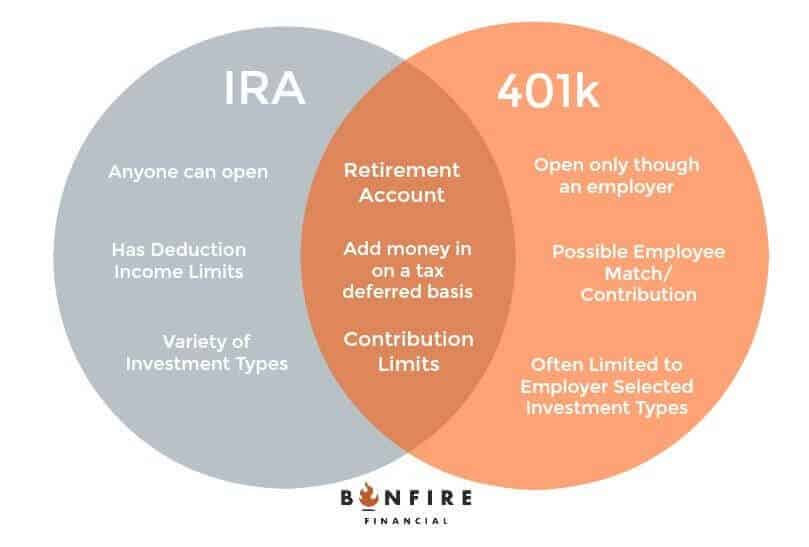

The allure of gold as a stable funding has persisted for centuries, with its intrinsic value typically serving as a hedge in opposition to inflation and market volatility. As traditional retirement accounts comparable to 401(k)s and IRAs are predominantly composed of stocks, bonds, and mutual funds, the introduction of Gold IRAs presents a unique different for those looking to protect their retirement savings. This article aims to provide insights into the workings of Gold IRA investment companies, the services they provide, and the elements that contribute to their growing recognition.

To gain a comprehensive understanding of Gold IRA investment companies, we conducted observational research by analyzing varied corporations in the business. This included reviewing their web sites, advertising and marketing materials, buyer testimonials, and regulatory compliance. The analysis highlighted a number of key players in the Gold IRA market, each with distinct choices and approaches to client engagement.

Some of the notable aspects of Gold IRA investment companies is their emphasis on schooling. Many firms provide in depth sources to help potential buyers understand the advantages and dangers related to investing in treasured metals. Educational webinars, informative articles, and personalized consultations are frequent practices amongst these firms, reflecting a commitment to empowering clients with data. This emphasis on education not only builds trust but additionally positions these companies as authoritative figures within the gold funding area.

Moreover, the strategy of organising a Gold IRA is a vital factor that influences investor decisions. Most Gold IRA companies streamline the setup process by providing consumer-friendly online platforms that information clients through the mandatory steps. This usually entails selecting a custodian, choosing the kind of gold to put money into, and funding the account. Some firms even provide help with rolling over present retirement accounts into Gold IRAs, making the transition seamless for buyers. Observational insights reveal that firms that prioritize a straightforward and clear setup course of have a tendency to draw a bigger shopper base.

Customer service is another pivotal component in the success of Gold IRA investment companies. Our observations indicated that companies with responsive and educated buyer support teams are more likely to retain shoppers and foster long-term relationships. Buyers often search reassurance and steering, particularly when coping with the complexities of valuable metallic investments. Firms that spend money on training their employees to offer distinctive service are inclined to receive greater satisfaction ratings from their purchasers.

The range of treasured metals supplied by Gold IRA investment companies can also be noteworthy. While gold is the primary focus, many corporations also enable investments in silver, platinum, and palladium. This diversification can attraction to investors looking to spread their risk across multiple assets. Observational knowledge means that firms providing a broader number of funding options have a tendency to attract a extra numerous clientele, as investors seek to tailor their portfolios in keeping with their individual risk tolerance and investment targets.

One other important issue influencing the choice of Gold IRA investment companies is the payment construction. Our analysis revealed that corporations with transparent and recommended firms for retirement gold-backed ira rollover aggressive price schedules are more likely to gain the trust of potential buyers. Widespread charges associated with Gold IRAs include setup fees, storage charges, and transaction charges. Observationally, companies that clearly outline these prices on their web sites and supply upfront estimates tend to foster a sense of transparency that resonates with purchasers. If you loved this article and you want to receive more details concerning recommended firms for retirement gold-backed ira rollover (recommended site) assure visit our own internet site. Conversely, companies that obfuscate their price buildings or implement hidden fees typically face skepticism and distrust from prospective investors.

Regulatory compliance is a important facet of the Gold IRA investment panorama. Observations point out that firms that prioritize compliance with IRS laws and trade requirements are likely to instill higher confidence of their shoppers. This consists of making certain that the gold and different precious metals held within the IRA meet the required purity requirements and are stored in permitted depositories. Companies that actively talk their compliance measures and regulatory adherence are extra doubtless to draw purchasers who prioritize security and legitimacy of their investments.

As the demand for Gold IRAs continues to develop, so too does the competitive panorama amongst investment corporations. Our observations counsel that corporations are increasingly leveraging digital marketing strategies to succeed in potential buyers. Social media campaigns, seo, and content material advertising are commonly employed to enhance visibility and entice a wider audience. Firms that effectively utilize these channels to coach and interact with potential shoppers typically see increased conversion rates and elevated brand loyalty.

In conclusion, the world of Gold IRA investment companies is characterized by a blend of education, customer service, transparency, and regulatory compliance. As traders search to protect their retirement savings from financial uncertainties, these firms play a pivotal role in facilitating access to precious metallic investments. Our observational analysis underscores the significance of those components in shaping investor decisions and highlights the evolving dynamics of the Gold IRA market. As the business continues to mature, will probably be essential for firms to adapt to changing investor preferences and maintain a commitment to transparency and training to foster long-term relationships with their clients.

댓글목록

등록된 댓글이 없습니다.